In the realm of retail and e-commerce, upselling and cross-selling are essential strategies for increasing revenue and driving business growth. However, many consumers may not have the financial means to purchase additional products or services at the time of their initial purchase.

This is where point-of-sale (POS) financing comes into play, providing consumers with the convenience of splitting the cost of their purchases into affordable installments at checkout.

To understand how POS financing can help in-store retailers and e-commerce businesses increase their AOV, repeat purchases, and customer satisfaction, we are going to cover:

- The concept of upselling and cross-selling

- Upselling strategies to boost sales

- How Skeps can help businesses enhance their upselling strategies

Let’s dive into each and get a better idea of how businesses can leverage POS financing to upscale their upselling strategies.

Understanding the Concept of Upselling and Cross-selling

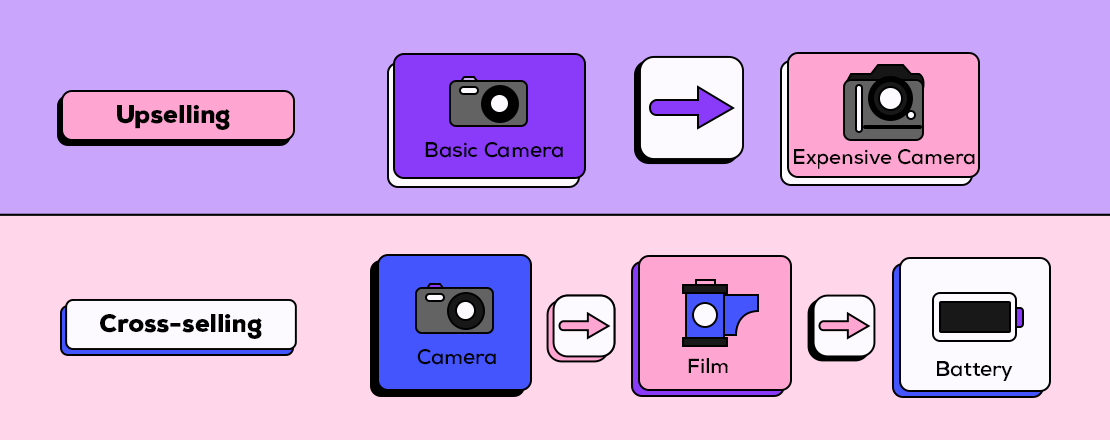

Before we dive into the role of POS financing in facilitating upselling and cross-selling, let us take a step back and define these concepts. Understanding the difference between these techniques and how they work together is crucial for any business looking to improve its sales and customer experience.

What is Upselling?

Upselling is a sales technique wherein retailers invite customers to purchase a more premium version of the product or service that they are already interested in buying. There are several benefits to upselling, both for businesses and customers.

With customers willing to pay more for a higher-quality product or service, upselling leads to increased revenue and profits for businesses. Since customers get better value for their money with products that meet their needs more effectively, upselling can significantly improve customer satisfaction.

Upselling requires retailers to carefully consider consumer needs, preferences, and the latest market trends. It should never feel pushy or manipulative but rather like a helpful suggestion that provides genuine value to your customers.

What is Cross-selling?

Cross-selling, on the other hand, involves offering customers additional products or services that complement or enhance the ones they are already purchasing. The goal is to provide customers with an extensive solution to their needs.

Cross-selling has benefits for both businesses and customers. With a good cross-selling strategy, businesses can enjoy better revenue and higher profits while customers get a more comprehensive solution to their problems.

Now that we have a clearer picture of how upselling works and the benefits it offers, let us explore some result-oriented strategies to implement in your retail business.

4 Upselling Strategies to Boost your Business

Here are four effective upselling tactics that can help boost your retail business, and reduce cart abandonment rates:

- Bundling: A bundle includes the original product that a customer was interested in purchasing, along with an upgraded or complementary product at a slightly lower price.

- Personalized recommendations: This involves using consumer data and insights to suggest personalized product recommendations that align with their needs and preferences, helping you build trust and improve the chances of a successful upsell.

- Provide social proof: Highlight positive customer reviews or testimonials for the upgraded product or service on your social channels. This can help build confidence in the customer's decision to upgrade.

- Offer financing options: Lower the burden on your customers' wallets with the freedom to finance their purchases. Offering pay-over-time POS financing solutions makes the cost of the upgraded product more manageable and increases the likelihood of an upsell.

How POS Financing can Help you Level up your Upselling Strategy

A BusinessWire study suggests that 76% of customers would prefer making retail purchases from merchants offering a hassle-free and seamless point-of-sale experience. Additionally, 62% reported favoring installment payment plans with simple payment terms.

The study also indicates that 66% of consumers would prefer to utilize alternative financing options at the point of sale to avoid making larger purchases via credit cards.

These statistics highlight the growing importance of POS financing in the retail industry, not only for facilitating upselling and cross-selling but for improving customer loyalty and retention.

Partnering with the right POS financing company can help you take your upselling strategy to the next level, leading to increased sales, improved cash flow, and reduced payment risk for your business.

Enhance your Upselling Strategy With Skeps

Skeps offers a state-of-the-art omnichannel POS financing platform that allows partners to white label and provides the widest variety of financing options. Working with a broad network of established lenders, we go beyond one-click payment, also offering a one-click application process for the diverse types of consumer financing options available, including:

- Installment loans

- Co-branded credit cards

- Promotional financing offers

If you’re looking to partner with a forward-thinking fintech company that will keep consumers' eyes on the purchase while offering best-in-class financing, Skeps is the perfect fit.

Do you have more questions about optimizing your upselling strategy? Request a demo or contact us at support@skeps.com.