Blockchain can surely change the game of both traditional and marketplace lending. Read on to know how loan marketplaces can benefit from Skeps.

Several reasons may compel your customers to borrow money. When looking at your options for funding, they may consider traditional lending or alternative lending. Traditional lenders are synonymous with banks or financial institutions. The new forms of lenders such as online lenders, peer-to-peer lenders, and loan marketplaces are categorized as alternative lenders.

Unlike banks, which take in deposits and lend money to businesses and consumers, alternative lenders do not take deposits or lend themselves. They make financial gains from commissions and fees generated by matching borrowers with appropriate lenders. Within these marketplaces, borrowers can interact with investors without the involvement of a traditional lender. The new forms of lenders come with lucrative benefits including less paperwork, more flexibility, and faster funding, due to which traditional lenders have to face progressively significant competition.

The rise of loan marketplaces

Originally brought up as peer-to-peer lending, these offerings were rebranded to loan marketplaces when industrial investors and hedge funds entered this space. A Morgan Stanley research suggests that presently there are over 200 digital lenders in the US, and global volume is predicted to surpass $290 billion by 2020*. Loan marketplaces have recently gained prominence following rapid growth in markets like the US, the UK, and China. They are disrupting consumer lending by meticulously blending advanced technology with data to decrease operating costs, improve borrower experiences, and reach underserved markets. From innovative credit models to anti-fraud tools and user-friendly interfaces, these marketplaces offer a compelling value proposition for both lenders and borrowers.

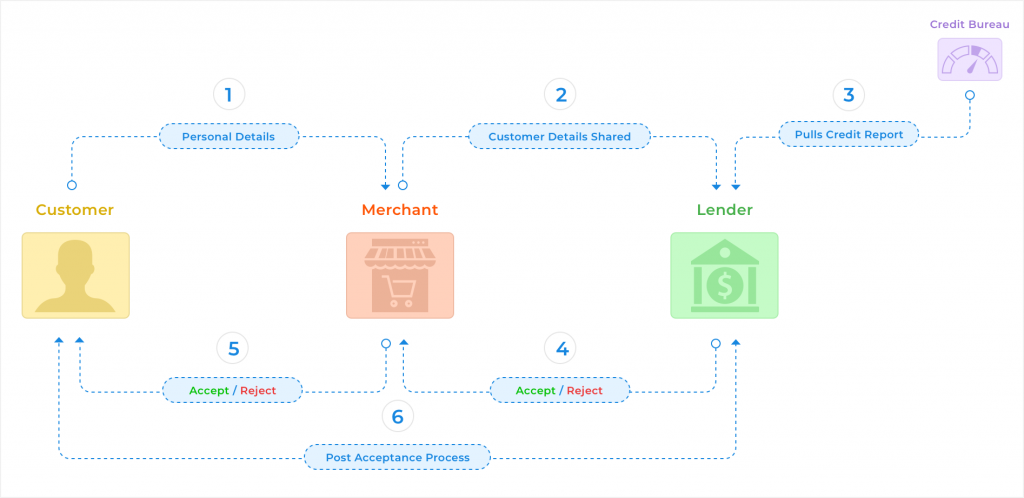

1. After deciding what to buy online, the customer shares his personal details with the merchant.

2. Merchant shares that detail with the lender.

3. The lender gets the credit report pulled by a credit bureau it has partnered with.

4. The lender shares the application status (Accept/Reject) with the merchant.

5. Merchant shares the same with the customer.

6. Post-acceptance process starts between the customer and the lender.

Decentralized lending — the game changer

While loan marketplaces might be creating convenient experiences for your consumers, the risk of their data being exposed to vulnerabilities still prevails. You cannot deny the control and pre-eminence that lies in the hands of only a very few individuals or aggregators. Simply put, with loan marketplaces your customer data is centralized.

Here, blockchain can surely change the game as it demonstrates the potential to disrupt both traditional and marketplace lending. Skeps is one such blockchain-based marketplace for consumer lending, which ensures a seamless, secured and personalized financing experience for customers. Through its easy-to-integrate product, lenders/merchants can offer their customers multiple loan options made available through partner lenders.

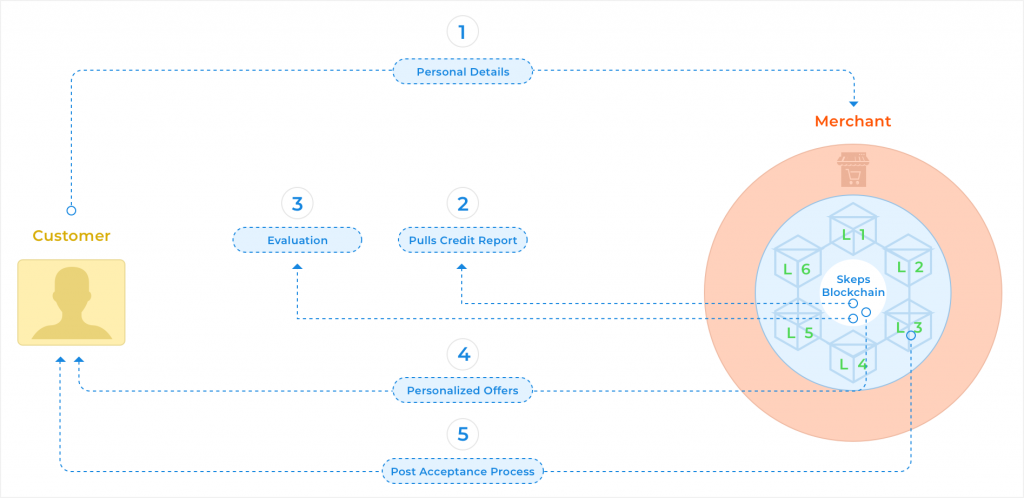

1. After deciding what to buy online, the customer shares his personal details with the merchant.

2. Skeps’ blockchain installed at the merchant’s infrastructure pulls out the credit report.

3. The credit report is evaluated.

4. Basis the credit report, personalized offers from multiple lenders are shared with the customer.

5. Post-acceptance process starts between the chosen lender; i.e. L3 and the customer.

Loan marketplace Vs Skeps blockchain

Skeps blockchain can decentralize the current system and upend the way loan marketplaces function in today’s world in the following ways:

Data Retention

In a loan marketplace, when your customer applies for a loan via aggregators, he receives offers from various lenders, again via aggregators. The aggregator, being the centralized body receives all your customer data. Skeps blockchain does away with this process. The data flows from your customer to Skeps’ decentralized blockchain and offers are presented to your customers. These personalized offers are based on the underwriting model shared by the lenders.

DATA PRIVACY

A loan marketplace is centralized, which makes it prone to cybercrime. When your customers apply for a loan, the data travels from the aggregator to the lenders, who share offers with the aggregator and then the customer chooses from the offers. With Skeps, data remains within the firewall of the merchants. In case of a loan application, Skeps collaborates with you to help your customers get the best offers. Normally, a drop off is seen when merchants ask for consent to share data. Skeps avoids the need for consent; hence higher conversion.

LIMITED CREDIT PULLS

Since aggregators share your customers’ data with multiple lenders, it is obvious that every lender is going to pull their credit report to check their loan eligibility. With multiple pulls of a credit report, your customers’ credit scores can be impacted negatively, and there is a possibility that the next lender might reject their loan application. On the other hand, Skeps requires a single pull of your customers’ credit reports. A single credit pull is enough to check the eligibility of your customers and present offers.

SINGLE ADVERSE ACTION NOTICE

Fair Credit Reporting Act (FCRA) mandates a lender to send an adverse action notification after a customer has been denied a loan application. Since customer data is shared with many lenders in a loan marketplace, every lender upon rejection of the application is supposed to send this notice to the borrower. With Skeps, there is one credit pull and so is the adverse action notice.

Skeps is surely a win for merchants and lenders; for merchants, it is higher customer conversion hence more sales. For lenders, it is higher funding volumes, hence more revenue. Contributing to a healthy lending ecosystem, it also ensures the highest standards of data privacy. Want to know more about us? Read “Hi! We Are Skeps”. If you want to join hands with us, request a demo now!

*Morgan Stanley Research: Global Marketplace Lending Disruptive Innovation in Financials, 2015